You have no items in your shopping cart.

Florida

This section of our website includes IRS 1099 Forms and W-2 forms for Florida business filers and tax professionals. If you are looking for 1099 E-File service we invite you to check out our W2 Mate program.

All our 1099 forms (for example, 1099-MISC forms, 1099 Retirement forms, and so on) follow the IRS "General Rules and Specifications for Substitute Forms 1096, 1098, 1099, 5498, W-2G, and 1042-S".

Our products are used by CPAs, accountants, banks, small businesses, universities, nonprofits and other professionals nationwide.

Please start by selecting a product from the list below.

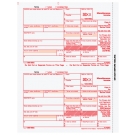

1099-MISC Recipient State Copy 2

$6.00 (per 25)

Use the 1099-MISC Recipient State Copy 2 to print and mail payment information to the recipient (payee) for submission with their state tax return. Learn More

1099-MISC Payer State Copy 1

$6.00 (per 25)

Use the 1099-MISC Payer State Copy 1 to print and mail payment information to the State. Learn More

1099-MISC Recipient Copy B

$6.00 (per 25)

Use the 1099-MISC Recipient Copy B to print and mail payment information to the recipient (payee) for submission with their federal tax return. Learn More

1099-MISC Federal Copy A

$6.00 (per 25)

Use the 1099-MISC Copy A to print and mail payment information to the IRS. Learn More

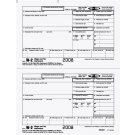

W-3 Transmittal

$6.00 (per 25)

Use the W-3 Transmittal form to summarize W-2 information for the SSA. Learn More

W-2 Employee File Copy C

$6.00 (per 25)

Use the W-2 Employee File Copy C to print wage and withholding information for employee files. Learn More

W-2 Employee Federal Copy B

$6.00 (per 25)

Use the W-2 Employee Federal Copy B to print wage and withholding information for employee submission with federal tax return. Learn More

W-2 Employer File Copy D

$6.00 (per 25)

Use the W-2 Employer File Copy D to print employer file copies.

Learn More| Items 11 to 19 of 19 total |

Page:

|

View: List Grid |